The Weekly Close #1

The week ahead in BTCUSD: If J-Pow doesn't surprise, a break out above 21K towards the 200WMA around 24K is in the cards.

BTCUSD broke the descending triangle to the upside but not in any spectacular way. The white line in the chart above is the 200-week simple moving average (200WMA). It’s the apparent target of any bullish price action and a crucial first hurdle to reclaim before we contemplate moon targets.

Let’s dig in. First, we add in last week’s horizontal support and resistance levels (HSR):

The 2017 all-time high (ATH), the middle blue line, has been acting stubbornly as Support since June. Last week we finally moved up and away from it but zooming paints a less bullish picture:

We can draw another HSR level around 21K, acting as Resistance for the last four months. This creates a Resistance-cluster between roughly 19.5K to 21K. Also, note the three consecutive Lower Highs (marked by the red arrows). There’s no reason to get excited as long as we keep chopping around this area.

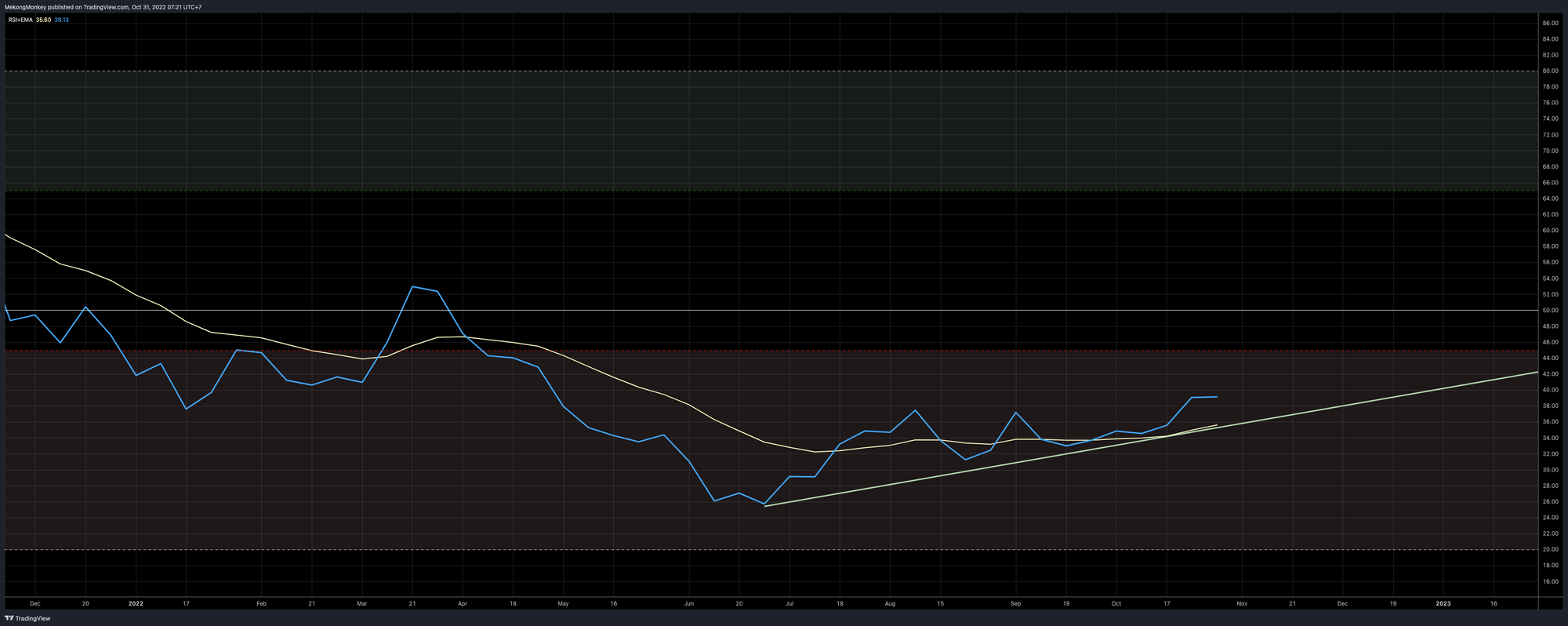

On the other hand, the momentum indicators could be interpreted as at the start of a bull run. The RSI has bottomed and has been on a nice upwards trend since June:

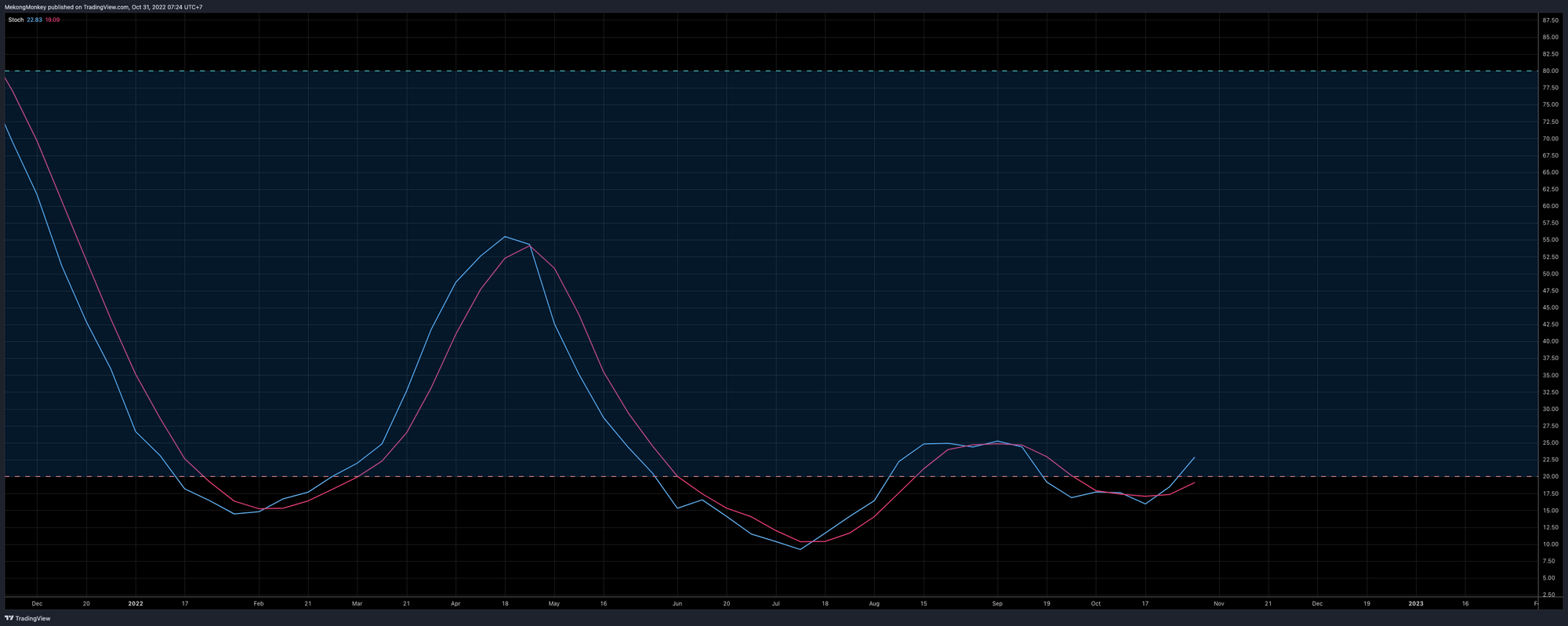

The weekly Stoch is, finally, peeping out of oversold conditions (above the dotted red line) and has plenty of room to run before getting anywhere near exhausted levels:

To bring it all together:

BTCUSD finally broke out of descending triangle without fireworks or fat, green candles. If we can continue the momentum, a break out above 21K towards the 200 SMA around 24K is definitely in the cards.

However, we live in Clown World, where global markets rise and fall depending on words spoken by a single man: Jerome Powell (aka J-Pow). We’re not claiming to be a macro specialist. Trying to articulate a few coherent thoughts about bitcoin now and then is pretty much near the limit of our abilities. But J-Pow will speak later this week, and markets will react. That’s the game we play.

If J-Pow says what markets expect him to say (another 75 basis points hike), BTCUSD will likely make a move higher (as discussed above), and there’s a good likelihood of tapping the 200WMA. However, if J-Pow surprises with a hawkish speech, all bets are off, and we’ll probably have to look at sub-20K levels again.

If and when BTCUSD reclaims the 200WMA, there’s plenty of upside left (to the moon, baby). In either case, right here, right now, is a tough place to take any position in the market. Sitting back and watching the action instead of participating is probably the best way to play it. It’s much easier to ride a trend than try to predict it.

Give us a follow on Twitter if you enjoy more market analysis throughout the week.

Thank you for reading, and until next week!

Not trading advice. You are solely responsible for your actions and decisions.