The Weekly Close #4: It's bitcoin, not crypto

BTCUSD is holding on above Support, but the headwinds are strong. Proceed with caution.

Dear friends,

After all the high-stakes drama from the FTX blow-up, last week went by relatively quietly. More fallout might still occur in the coming weeks or months, but BTCUSD managed to close the week above 16K Support.

The FTX drama makes the difference between bitcoin and crypto more evident than ever for anyone who still needs a reminder. Exchanges have been inflating the actual supply of bitcoin by selling “fake bitcoin” IOUs. Exchange bankruptcies, like the FTX blow-up, remove the artificial supply from the market while incentivizing people to withdraw bitcoin from still-solvent exchanges to their self-controlled wallets. This will show us the genuine supply and demand in this market. There’s still too much FUD (fear, uncertainty, doubt) and the possibility of further contagion to see a strong bid here. But in time, when the market is cleared of the bad actors, bitcoin will still be here (your favorite shitcoin might not), and we’ll continue the journey toward 200K.

Bitcoin is sovereignty and freedom. 12 words in your head, and nothing anything can do about that. Crypto is a centralized Ponzi scheme.

#Bitcoin not “crypto” pic.twitter.com/INsz7B4Uib

— Alan ₿ Watts ⚡️ (@alanbwt) November 16, 2022

Although, with the way mainstream media portrays shitcoin scammer SBF, hyperbitcoinization is probably not in our immediate future:

Sam Bankman-Fried donated 100s of millions of dollars stolen from FTX customers to politicians and related organisations.

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) November 17, 2022

The New York Times, Washington Post and Reuters are now whitewashing his actions which have ruined millions of lives.

Propaganda & corruption in action. pic.twitter.com/66Aw72oshx

Now let's look at some charts:

The January 2018 breakdown level, around 16K, is still acting as Support. Although the failure to move up and away from the level is not precisely confidence-inducing.

Nevertheless, the week closed above Support, so a move upwards to 20K Resistance remains more likely than a breakdown to the next Support level around 12K:

When we connect the 2018 bottom with the 2020 covid-crash weekly close, it connects perfectly with the latest breakdown candle. This bullish trend line should offer additional support for the price:

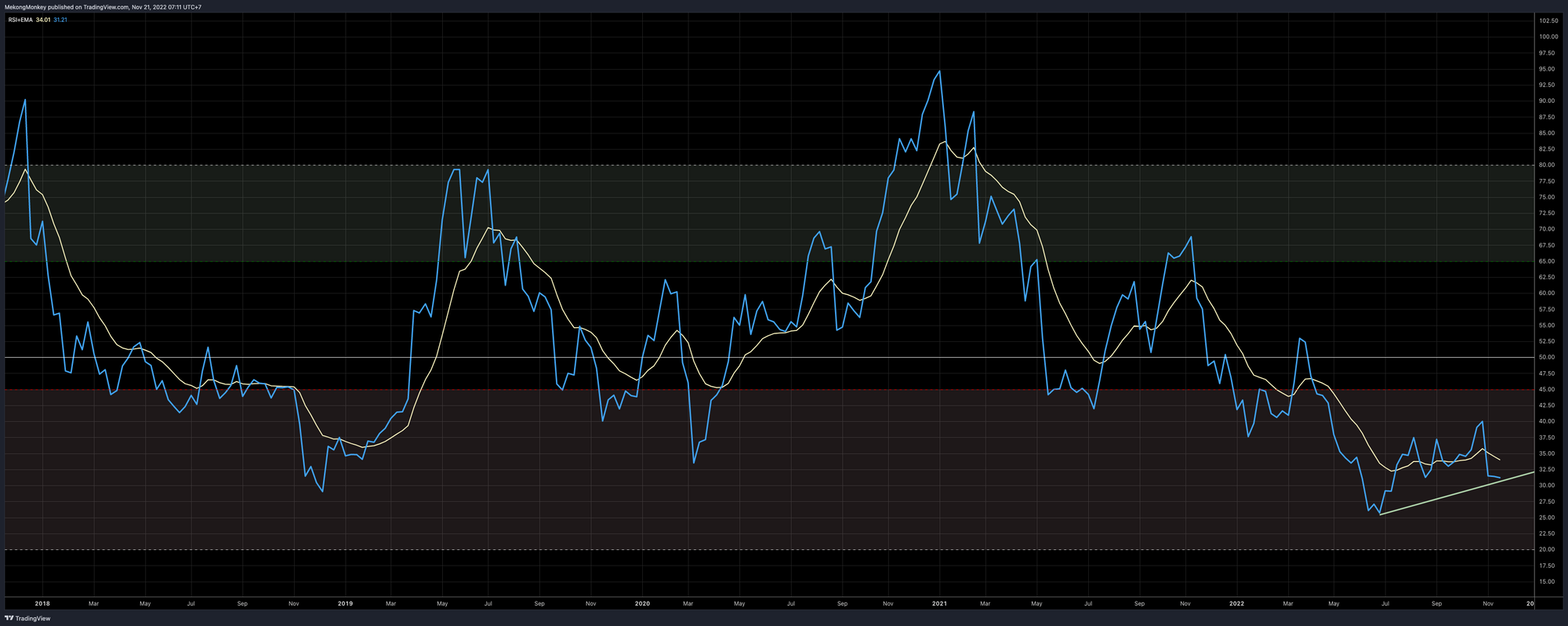

Not much has changed with our momentum indicator, the RSI. Bullish divergence (when the price makes a lower low, but the RSI makes a higher low) between the June low and today is still in play:

To bring it all together:

BTCUSD has arrived at an important crossroads.

We are above a major Support level, above a major bullish trend line, and there's bullish divergence on the RSI.

On the other hand, there's a massive fear of further contagion in the markets. If there are other 'crypto' companies going bankrupt, it's very likely they will drag BTCUSD down with their fall, and the drop to 12K is a real possibility.

If you are a DCA (dollar-cost-averaging) humble sats-stacker, there's nothing to worry about. Keep doing what you're doing. You'll be glad you added some more to your stash at these discounted prices.

On a shorter time horizon, it's a tough spot. Support is holding, but we are facing strong headwinds. Proceed with caution.

Inspirational tweet before you go:

⚓️ B-T-Sea Shanty #9 ⚓️

— BTC Minstrel (@BTCMinstrel) November 13, 2022

Fair or foul, bull or bear

The blocks will still be mined

We all keep stacking 'cause we must prepare

For one past midnight Moscow time.

🔊🎶 Sound On 🎶🔊 pic.twitter.com/HnwkZcQFsZ

Have a great week, dear friends, and take good care of yourself and your loved ones. You can reach us on Twitter, Telegram, or by e-mail, if you have any comments, questions, or suggestions.

Greetings from Phnom Penh, and talk again soon!

Not trading advice. You are solely responsible for your actions and decisions.