The Weekly Close #16: First Contact

Bitcoin's back at the 200-week SMA.

Dear friends,

BTCUSD made contact with its 200-week Simple Moving Average (SMA) for the first time since last August. Let’s go to the charts to discover what this means and where the price might go in the week ahead.

📈 The weekly bitcoin chart

After six months of drifting below it, bitcoin finally made contact with the all-important 200-week SMA (white line). At the end of January, the first attempt didn’t quite get there, but now, after only a shallow dip, the price is at this crucial level again.

Here’s the broader overview:

The weekly bitcoin chart with the significant Horizontal Support Resistance levels (HSR, in blue), the bullish trend line (in green), the 21-week Exponential Moving Average (21 EMA, yellow), and the 200-week SMA.

Time spent below the 200 SMA is an anomaly in the history of bitcoin. Reclaiming it would prove bitcoin critics wrong once again and crystallize the golden opportunity we all had in the previous months to scoop up sats at heavily discounted prices.

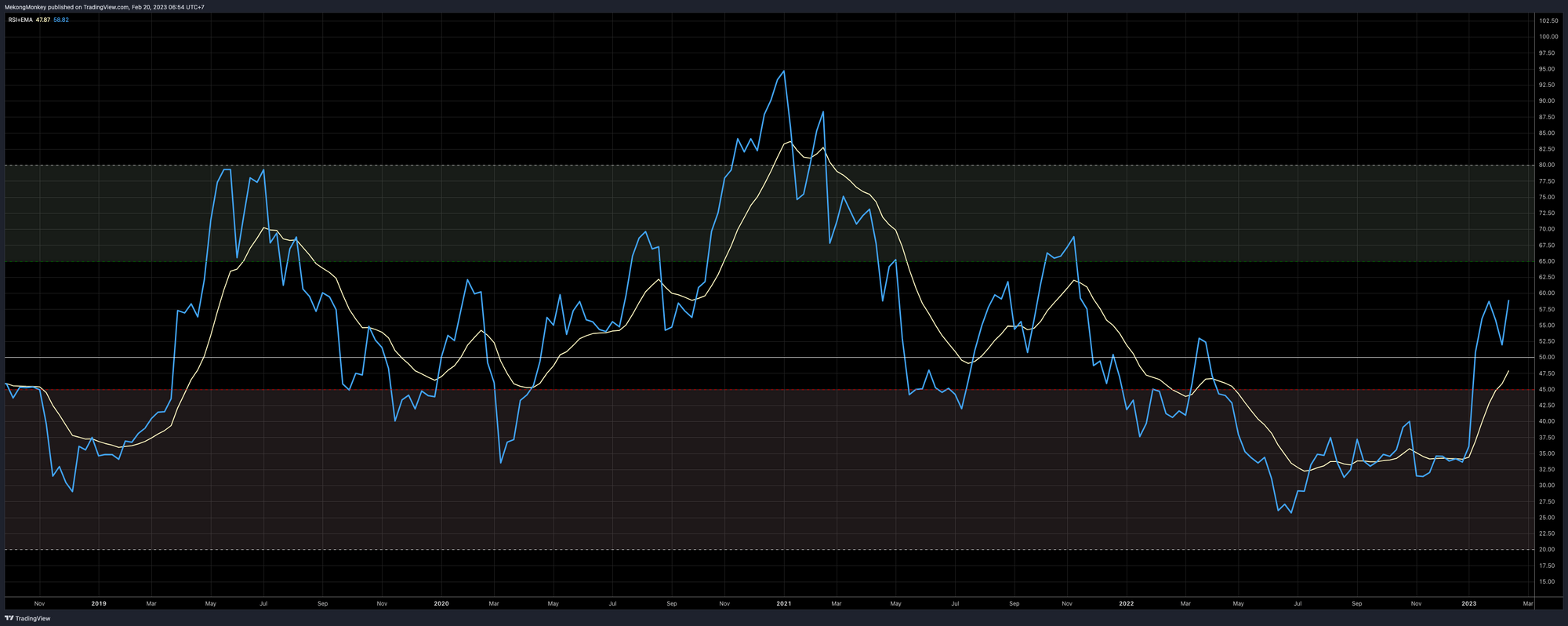

The Relative Strength Index (RSI) is in excellent shape:

The RSI (blue) is pointing up, above its EMA (yellow), above the midpoint (white horizontal), well out of bearish territory (red area), and hasn’t even entered the bullish territory (green area) yet. This suggests price has plenty of room to rise before running out of steam.

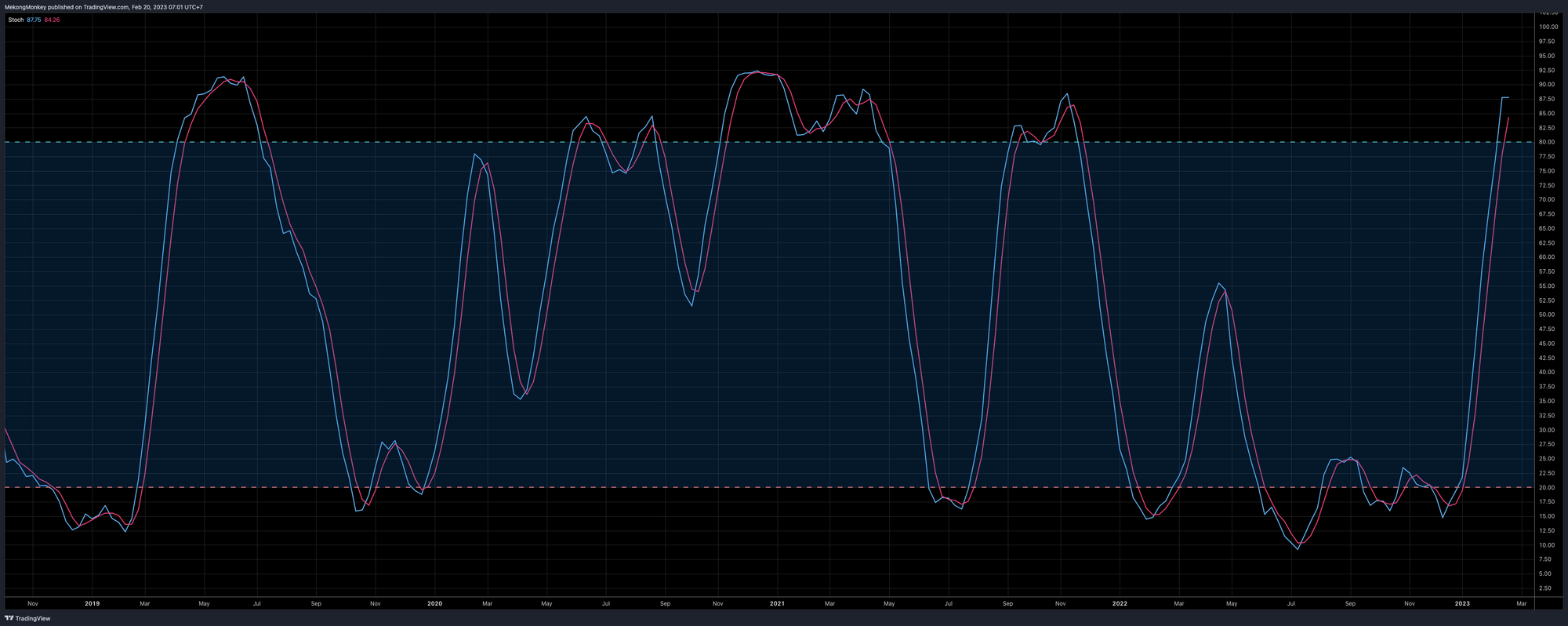

The Stochastic Oscillator is getting somewhat overheated:

This might suggest some caution is in order. However, when the other metrics are screaming bullish, the Stoch can remain elevated for long periods.

🔮 To bring it all together:

Technically bitcoin closed the week below the 200-week SMA, which means this Resistance level is intact, and the price will most likely move lower again.

However, the way we got here is essential to consider:

- BTCUSD lost the 200-week SMA in June 2022.

- In August, a retest of the 200 SMA failed dramatically.

- The failure sends the price to new cycle lows.

- After spending weeks sitting on the ledge of the bullish trend line, bitcoin reclaims the 21 SMA and quickly rises to almost but not quite touching the 200 SMA.

- In stark contrast with the previous attempt, the price doesn’t reject heavily this time. It turns back up before testing any significant Support levels and holds steadily right below the crucial level.

Alright, monkey, so up or down?

We feel pretty excited and could easily see the price explode upwards and punch to $28.8K in one big move. However, that is by no means a sure thing.

We can be reasonably confident that the market will not offer a perfect entry point. When bitcoin breaks the 200 SMA, it will go higher fast. On the other hand, if the price were rejected, it probably doesn’t stop before hitting the 21 SMA.

So, the price is currently around $24.4K. If the bullish case plays out, we could reach around $28.8K by next week. However, if the bears regain control, we go down to, at least, the $20 - 21K area.

History suggests that betting on the upside is the better move. However, the future’s always uncertain, and there are no guarantees. Always do your own research.

In case of doubt, stay humble and stack sats.

Have a wonderful week, dear friends; take good care of yourself and your loved ones. You can reach us on Twitter, Telegram, or e-mail if you have any comments, questions, or suggestions.

Nostr pub key: npub1v5jycyudhv64tm4q66vjeqcvxrpgk6u507xypt44cc55ghyh7mqq42suxz

Download Damus on mobile or try snort in your web browser.

Greetings from Phnom Penh, and talk again soon!

Support The Weekly Close by using these excellent services:

- HodlHodl: buy and sell bitcoin peer-to-peer without counterparty risk.

- Rollbit: up to 1000X bitcoin leverage futures. Instant execution. 0% Slippage. 0% Fees on loss.

- Satsback: earn sats when shopping online.

We appreciate your support! ⚡MekongMonkey@stacker.news

Not trading advice. You are solely responsible for your actions and decisions.