The Weekly Close #19: Hold the line

In a bad week for the global financial system, bitcoin managed to avoid death once again and hold onto its range. This is another potent sign for things to come. Keep stacking sats and hodl on.

Dear friends,

There’s a lot of mayhem in the global financial system. Banks collapse, financial distress, fear, uncertainty, and doubt.

Nick Bhatia wrote an enlightening piece on it on Sunday:

The BTCUSD chart lives on the border of a sound financial system and clown world insanity. Bitcoin has been doing what it has been doing for the last 14 years flawlessly: producing a block of uncensorable transactions every 10 minutes. No bank runs, bailouts or government interventions are possible in the hardest monetary asset in the world.

So, let's dive in and figure out what's going on at the frontier of a bright, orange future and the global financial casino:

📉 The weekly bitcoin chart

Here's our trusty weekly BTCUSD chart with all the usual lines and indicators. Significant Horizontal Support Resistance levels (HSR, in blue) are around $11.6K and $28.8K; mid-range HSR levels are around $16K and $20K. The green diagonal is the bullish trend line, holding up the price during the 2020 covid crash and, more recently, after the FTX blow-up. Then there's the 21-week Exponential moving average (EMA) in yellow and the most important line on the chart, the white 200-week Simple Moving Average (SMA).

The BTCUSD price action looked terrible for the last few days. However, patience pays, which is a clear example of why waiting for the weekly close results in a much clearer signal amid the noise. The weekly bitcoin candle wicked down to $20K HSR but recovered in the final hours of the week to close well above the 21-week EMA, thus keeping the range intact.

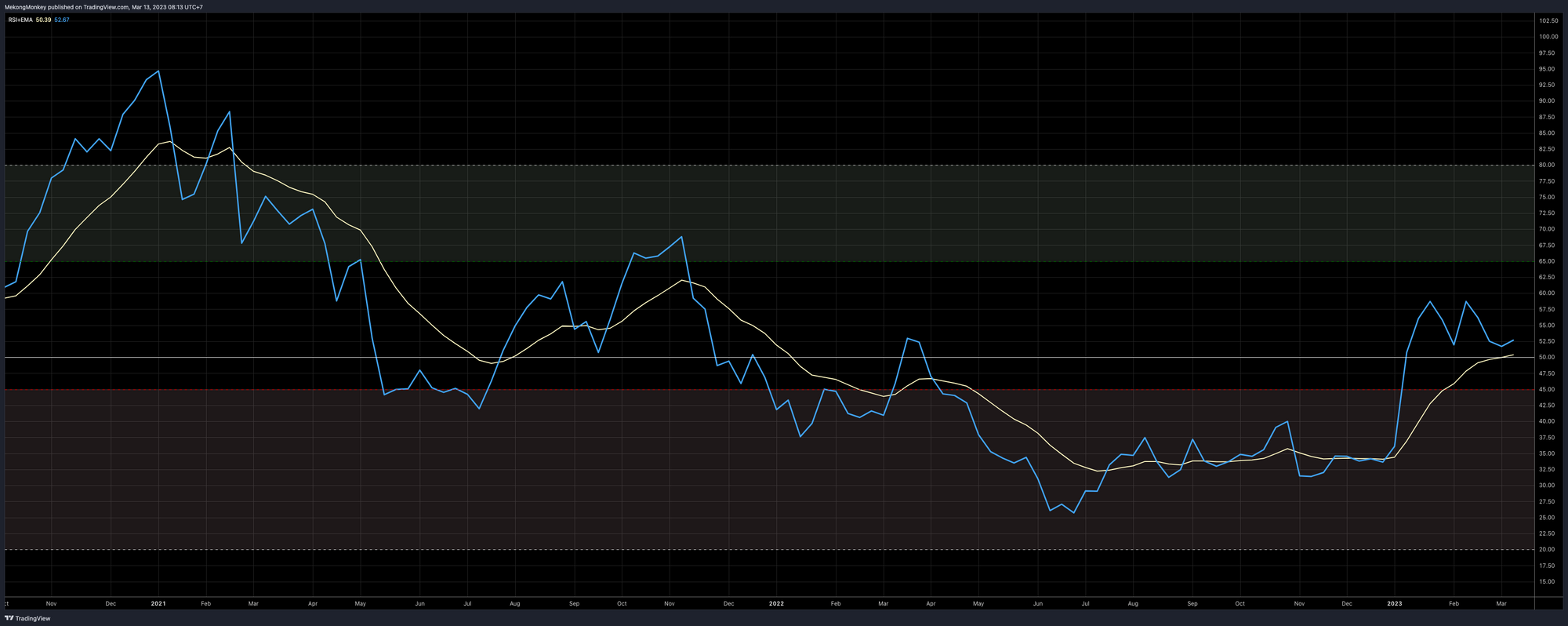

The weekly Relative Strength Index (RSI) is holding on above the midpoint (white horizontal) and the EMA (yellow line). The momentum remains neutral to bullish.

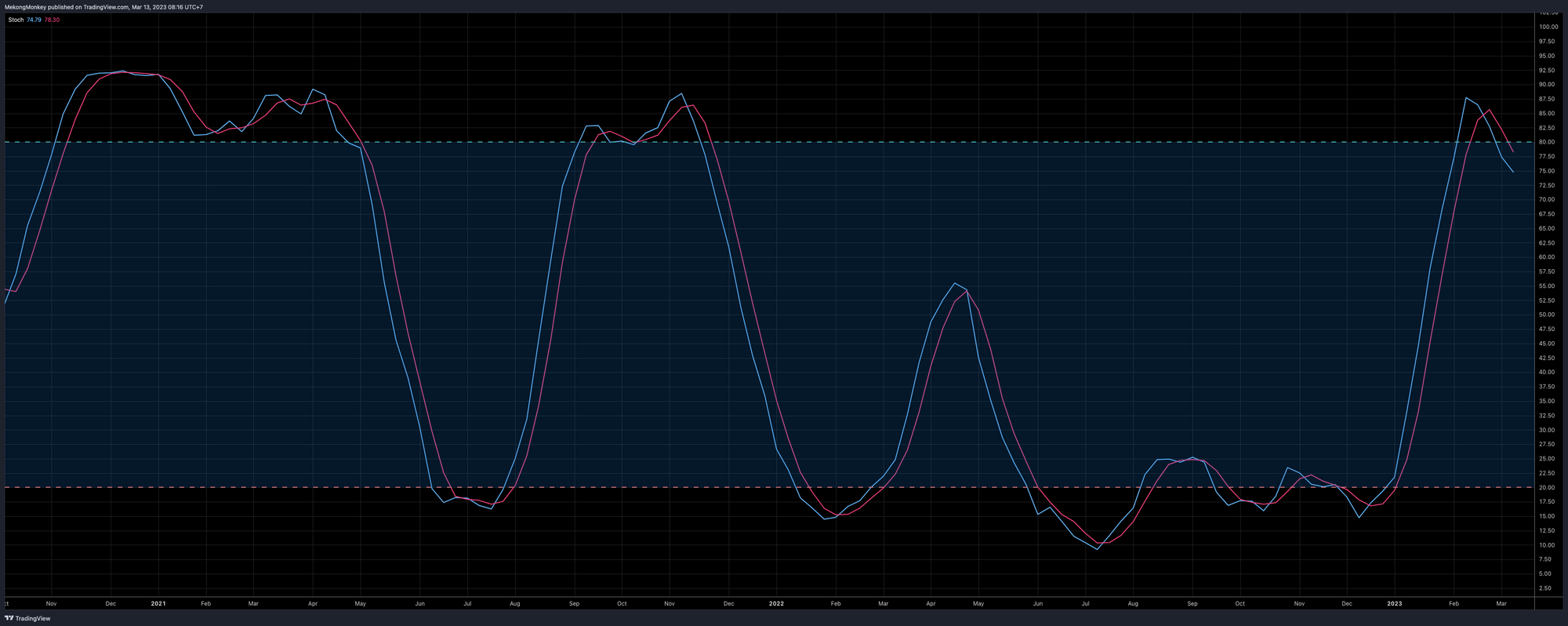

The Stochastic Oscillator (Stoch) disagrees with the RSI; it has exited oversold conditions (the black area above 80) and is firmly pointing down. This is bearish. However, a general lack of momentum is confirmed whenever multiple indicators disagree. The bitcoin price remains confined between its 21-week EMA and its 200-week SMA.

🔮 To bring it all together:

Bitcoin had a scary week with lots of daily red candles. However, in Sunday's final hours, BTCUSD recovered into the same old range with the 21 EMA as the lower border and the 200 SMA as the top border.

Technical analysis suggests that a failed attempt to break one side of the range usually leads to an effort to break the opposite side. So, another attempt to break the 200-week SMA looks likely from here. If it's successful, the price could be above $30K by the end of the week.

However, timing moves is a tricky thing to do. There's always a chance for more sideways action or an unlikely chain of events leading to different outcomes. Nevertheless, in a bad week for the global financial system, bitcoin managed to avoid death once again and hold onto its range. This is another solid sign for things to come. Keep stacking sats and hodl on. One day you will look back and be glad you scooped up some sats around $20K.

Keep calm and HODL

HODL ✊ pic.twitter.com/cRZBgLjLD1

— Bitcoin Magazine (@BitcoinMagazine) March 10, 2023

Have a wonderful week, dear friends; take good care of yourself and your loved ones. You can reach us on Twitter, Telegram, or e-mail with any comments, questions, or suggestions.

Nostr pub key: npub1v5jycyudhv64tm4q66vjeqcvxrpgk6u507xypt44cc55ghyh7mqq42suxz

Greetings from Phnom Penh, and talk again soon!

Support The Weekly Close by using these excellent services:

- HodlHodl: buy and sell bitcoin peer-to-peer without counterparty risk.

- Rollbit: up to 1000X bitcoin leverage futures. Instant execution. 0% Slippage. 0% Fees on loss.

- Satsback: earn sats when shopping online.

We appreciate your support! ⚡MekongMonkey@stacker.news

Not trading advice. You are solely responsible for your actions and decisions.